Introduction

Ratio analysis entails the qualitative evaluation of data presented in the financial statements including balance sheet, income statement as well as the cash flow statement. The computation may include a comparison of one item with another or a combination of them. The significance of ratio technique comprises of the evaluation of various aspects of a companys operations as well as its financial performances. That may include liquidity, profitability, solvency, and efficiency. A trend of the ratios over a given period also assists in the determination of whether the companys performance improves or deteriorates.

The most common ratios can become clustered into several groups including profitability, leverage, liquidity, debt, and activity ratios. The objective of the paper is determination of the availability of cash to settle debts, return on assets, and capital budgeting. It also seeks to establish the return on shareholders equity as well as increase in shareholders wealth for Microsoft Corporation and Apple Incorporation. The two are American tech giants, with their business spread all over the globe. The companies have an immense impact in the information technology industry, in which they operate.

How Liquid Are the Firms?

The liquidity of business could be determined through the use of various relationships including current ratios, acid-test ratio, cash ratio, and operating cash flow. The aim is to establish the ability of the firm to repay its debts and not fall into bankruptcy.

Table 1

Microsoft Corporation

|

Ratio/ Year |

2015 |

2014 |

2013 |

|

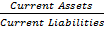

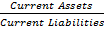

Current Ratio = |

2.50 |

2.50 |

2.71 |

|

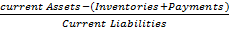

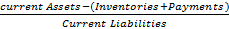

Acid-test Ratio = |

2.44 |

2.45 |

2.66 |

|

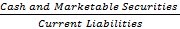

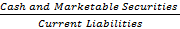

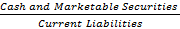

Cash Ratio = |

1.94 |

1.88 |

2.06 |

|

Debt Equity Ratio = |

0.35 |

0.23 |

0.16 |

Tale 2

Apple Inc.

|

Ratio/ Year |

2015 |

2014 |

2013 |

|

Current Ratio = |

1.11 |

1.08 |

1.68 |

|

Acid-test Ratio = |

1.08 |

1.05 |

1.64 |

|

Cash Ratio = |

0.52 |

1.88 |

2.06 |

|

Debt Equity Ratio = |

0.45 |

0.40 |

0.93 |

Place New Order

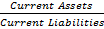

Current Ratio

Microsofts current ratio is quite high indicating the corporations ability to pay its short-term liabilities on time and without major difficulties. However, it has recorded excessively high for the last three years including 2013, 2014 and 2015, that is beyond the recommended level. The ratio registered in the years included 2.50, 2.50, and 2.71 for 2015, 2014, and 2013 respectively. Although the firm does not face core threats to bankruptcy, the ratio indicates its failure to utilize its current assets to the fullest for the expansion of its activities.

On the other hand, in regard to the current ratio, measure shows a fluctuation for Apple Inc. depicting wavering difficulties in settling the short-term debt. In fact, in 2013, the company seems to have performed better in comparison to 2014 when it lowered before rising by a small margin in 2015. Nevertheless, the corporations rating per the ratio does not indicate a good health as it remains below the recommended 1.5 on the minimum. That shows more debts overburdening the business, and it could get to a point where it fails to sustain it. Again, there is excessive pressure exerted on assets to service the liabilities. Hence, among the two companies, current ratio suggests Microsoft Corporation as having more liquidity than Apple Inc. and hence better chances of meeting its creditors demands. However, Microsoft requires applying its current assets as a financing facility efficiently.

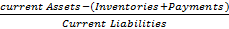

Acid-Test Ratio Quick Ratio

The ratio determines the ability of a business to finance its activities using the close to cash assets. The recommendation for this kind of relation is given as 1:1. A higher quick ratio indicates better liquidity for the company in question. The two companies seem to have met the required level (Bull, 2007). However, Microsoft indicates a more stable and stronger ratio than in the case of Apple Inc. and thus is considered as better positioned to settle debts fast and meritoriously. Nevertheless, the acid-test ratio does not offer a proper evaluation as does the current ratio and hence may indicate a healthy company even when it does not represent the reality.

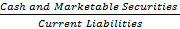

Cash Ratio

It measures the timeliness of a company to settle its creditors. In addition, it excludes accounts receivables during its computation hence representing a clearer picture of the ability to repay debt swiftly (Tracy, 2012). Again, the higher the ratio, the better will be the health of the company. Both Apple and Microsoft indicate sharp decline in the ratio, which is something attributable to the declining assets or increasing liabilities. Nonetheless, Microsoft Corporation does show better prospects than Apple.

Profitability Ratio

The ratios assist in the assessment of a firms capacity to generate earnings in comparison to the expenses as well as other necessary costs sustained for a span of time (Bull, 2007). The ratios tested in this case will include operating margin, gross margin, return on assets (ROA), and Return on Equity (ROE).

Table 3

Profitability Ratio of Microsoft Corporation

|

Ratio/ Year |

2015 |

2014 |

2013 |

|

Gross Margin = |

64.70% |

68.98% |

73.99% |

|

Operating Margin = |

19.41% |

31.97% |

34.38% |

|

ROE = |

23% |

31% |

34% |

|

ROA = |

7.00% |

14.02% |

16.58% |

Table 4

Profitability Ration of Apple Inc.

|

Ratio/ Year |

2015 |

2014 |

2013 |

|

Gross Margin = |

40.06% |

38.59% |

37.62% |

|

Operating Margin = |

30.48% |

28.72% |

28.67% |

|

ROE = |

46.25% |

33.61% |

30.64% |

|

ROA = |

20.45 |

18.01 |

19.34 |

Are the Firm’s Managers Generating Adequate Operating Profits on the Company’s Assets?

Operating Margin

The ratio has also become regarded as a return on sales. It shows the profitability of a firm and may compare companies and industries regardless of their sizes. It helps determine a companys operating efficiency as well as its pricing strategy. In addition, it gives the remaining proportion of a firms revenue after settling variable expenses incurred during the production process. Such expenditures include the wages and the costs of raw materials. It gets computed through the division of operating income over a given timeframe, with the net sales made within the same period. The ratio gets expressed as a percentage (Tracy, 2012). The higher it gets, the better it is for the company as it depicts the amount of sale percent reverted to the corporation as part of net profits after the deduction of all activity related costs.

- Our custom writing services includes:

- Plagiarism and AI free custom writing for the best grades;

- CV, resume and cover letters which would

make you successful - Thesis and dissertations writing by academic

authors

Further, it proves that the company makes returns from the undertakings. Using the ratio to evaluate the two, it becomes evident that Microsoft faces challenges in making earnings from internal production activities. On the other hand, Apples operating margin has seen a constant rise since 2013 and hence improving the performance. Along with that, the posting by Apple remains far much lower than those of Microsoft, which indicates that Microsoft performs better despite showing a declining trend.

According to these results, the operating profits remain low, especially for Microsoft, which has experienced declines over the three-year period. Although Apples is low as well, there is an encouraging trend indicating the rise of the margin. A higher operating margin specifies the growing profits for the operations (Tracy, 2012). As such, it may be concluded that the operating profits at Apple Inc. are growing while those of Microsoft Corporation are on the decline.

How Are the Firms Financing Their Assets?

Gross Margin

It is the division of the difference between revenue and cost of sales by the revenue, and further expressing it as a percentage. It makes a representation of the proportion of the sales revenue totals retained by a firm after suffering direct costs connected to the production of goods as well as services that the business sells. A higher percentage indicates a bigger share of funds reserved for every sales dollar and usable to paying other obligations as well as costs (Bull, 2007). Microsofts gross margin records a decline in comparison to Apples, which appears to be a rising trend. However, the latter still performs poorly compared to the former. With Microsoft showing a gross margin of 64.70% and Apple 40.06%, it becomes evident that the former has a better reserve for the funds in comparison to the latter. That is the case with a difference of 24.64% retention rate for every dollar.

Return on Assets (ROA)

The ratio tells of the profitability of business in relation to total assets. It also gives an opinion on the efficiency of the management in making use of assets for earnings generation. It has also become known as the return on investment (Tracy, 2012). Further, it has shown the capital intensity of a firm. For this measure, Apple appears to have performed much better than Microsoft. It appears that Apple ensures better utilization of its assets than does Microsoft Corporation. Thus, the former has got considered better in the conversion of investments to profits. On the other hand, Microsoft has shown not only small but also fast declining ability to fulfill this goal.

Are the Firm’s Managers Providing a Good Return on the Capital Provided by the Shareholders?

Return on Equity (ROE)

It indicates the amount of net income that gets returned as a percentage of owners equity. Again, it establishes a firms profitability through the revelation of the total fund generated from what the shareholders had invested. In this regard, it also determines a companys efficiency in generation of earnings as well as its growth. It has significance in showing whether the equity holders are having good returns for their money. A higher ratio shows an efficient management in the utilization of capital base as well as attractive returns for the investors (Bull, 2007). Both Apple and Microsoft show good performance within the recommended range. However, Microsoft makes better returns to its shareholders than does Apple. Despite that, Apple shows an increasing trend to what the equity holders derive from the business while Microsoft faces a decline.

In Apple Inc., the growth has been constant for the three years and increasing. That is a good indication that shareholders are getting back the value of the resources they have injected into the firm. However, the returns remain average. On the other hand, Microsoft Corporation has a worrying trend. The return on the shareholder capital appears to have dwindled for the last three years. Moreover, the fall has already entered the lower quarter and indicates all is not well about the shareholders equity.

What are you waiting for?

Order with 15% discount NOW!

Are the Firms Managers Creating Shareholder Value?

Table 5

Debt-Equity Ratio

|

Ratio/ Year |

2015 |

2014 |

2013 |

|

|

Microsoft Corporation (Yahoo Finance, 2016) |

Debt Equity Ratio = |

0.35 |

0.23 |

0.16 |

|

Apple Inc. (Yahoo Finance, 2016) |

Debt Equity Ratio = |

0.45 |

0.40 |

0.93 |

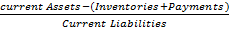

Debt-Equity Ratio

It rations a firms financial leverage by the division of the total liabilities by the shareholders equity. It also tells the quantity of debt used by the company to fund its assets compared to the value amount characterized by the shareholders equity. A higher ratio is better as it shows that the business utilizes other peoples finances to generate wealth (Tracy, 2012). However, the ratio should always remain below one to ensure that the company does not burry itself in debts. As such, comparing the two options, it has become quite notable that Apple Inc. makes use of this option that does Microsoft. Hence, the former will most probably be exposed to more resources for expansion and growth than the latter. Nonetheless, this is not a sole determinant of the health of business.

The ratio is usually an indicator of the forecasted better times ahead. As such, it becomes some sort of assurance that the managers are keen on raising the value of shareholders, without demanding more funds from them. Therefore, from the results it is evident that Apple is in a better position to increase owners equity in comparison to Microsoft Corporation.

Conclusion

The analysis and comparison of the two companies portrays a different perspective of each of them regarding their financial health as well as efficiency. According to the analysis, Microsoft seems to perform well on liquidity ratios showing the firms ability to settle debts using the short-term assets. In this category, Apple Inc. does not display good performance, which is something that could mean difficulties in the conversion of assets into liquid money and thus inability to settle debts using them. Again, in terms of the profitability ratios, Microsoft performance has been recorded high though declining. On the other hand, Apple is still behind despite the improvement. However, in terms of the shareholders equity, Apple Inc. has outshone Microsoft Corporation depicting itself as capable of making high returns for its investors. Further, the company has also portrayed its ability to utilize assets properly in the generation of profits for the shareholders better than the case of Microsoft.